november child tax credit amount

November 15 2022 Set As Deadline To Claim The 2021 Child Tax Credit Stimulus Check. The enhanced child tax credit which was created as.

The Child Tax Credit The White House

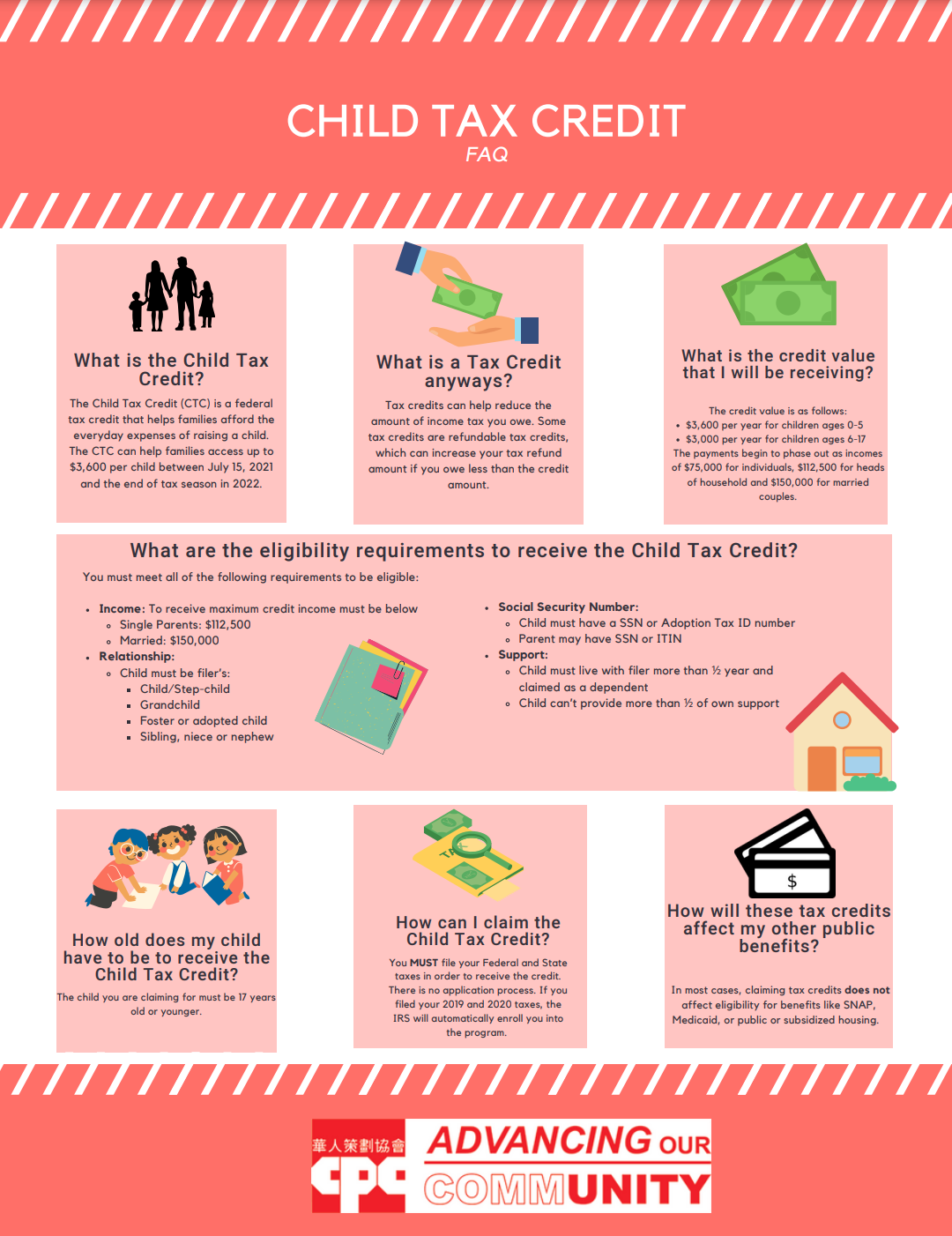

For 2021 eligible parents or guardians.

. THE child tax credit program continues with another payment set to be issued next weekAs part of President Joe Bidens American Rescue Plan qualif. Here are some numbers to know before claiming the child tax credit or the credit for other dependents. The IRS has confirmed that theyll soon allow.

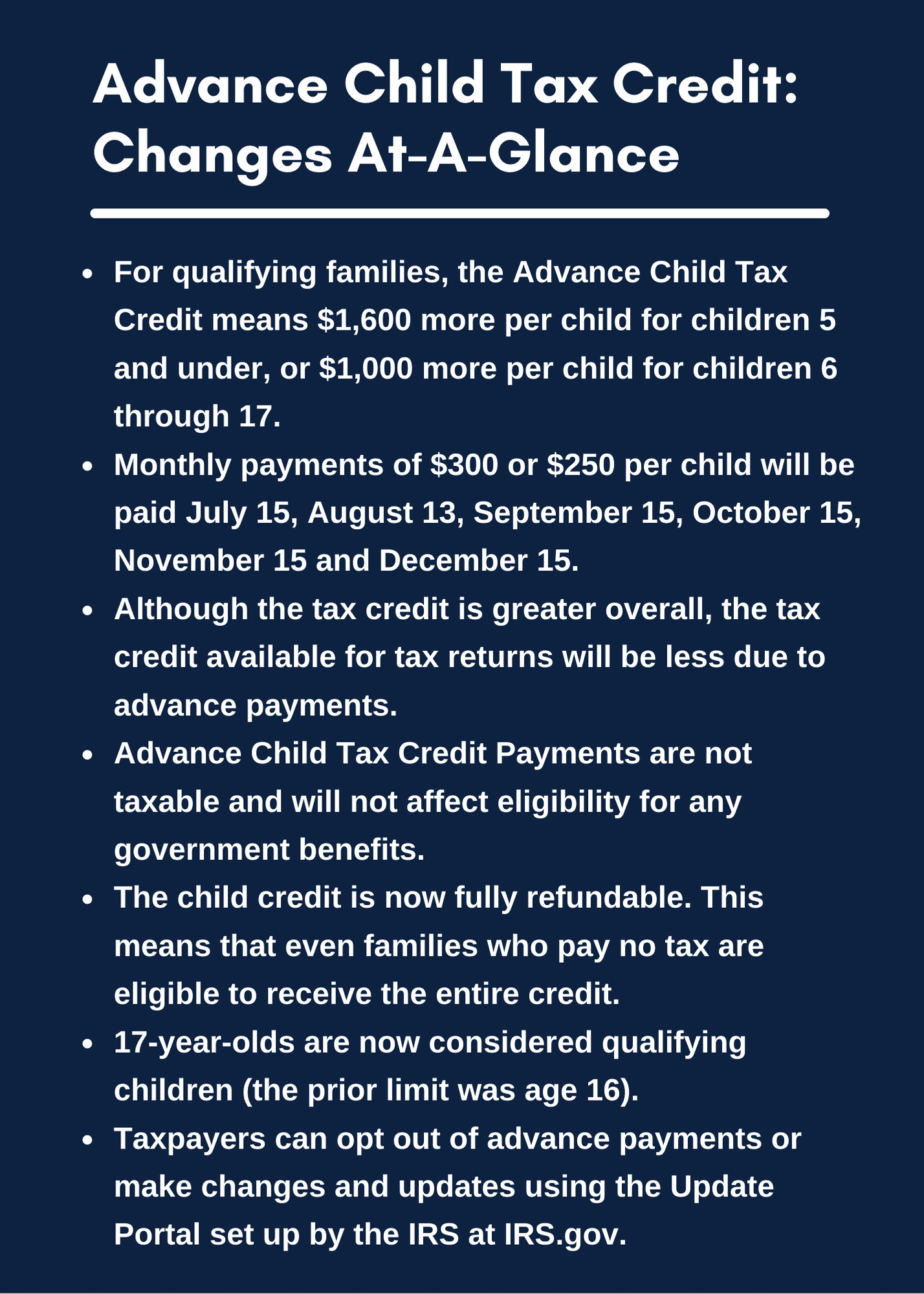

Parents still have time to claim their expanded child tax credit stimulus check. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit. Have been a US.

Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax liability. The maximum child tax credit amount will decrease in 2022. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. If we had not processed your 2020 tax return when we determined the amount of your advance Child Tax Credit payment for any month starting July 2021 we estimated the.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Meanwhile parents with children between the ages of six and 17 will receive up to 1500 in six monthly payments of. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

The maximum amount of the child tax credit per qualifying. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040. If your 2021 income exceeds that threshold you may need to return a portion of the tax credit.

Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax liability. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

Liability by the amount of the child tax credit. A childs age determines the amount. Liability by the amount of the child tax credit.

The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5. The IRS will soon allow claimants to adjust their. However if youre making under 40000 per year you dont need to pay back.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The credit expiration date is a onetime extension.

The October child tax credit payment will arrive this week. For each kid between the ages of 6 and 17 up to.

Stimulus Update Here S When To Expect The November Child Tax Credit Payment Silive Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline The Us Sun

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

When Is My November Child Tax Credit Coming Irs Payments Wtsp Com

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Child Tax Credit Updates November Payments Starting Today Marca

Sign Up For The Child Tax Credit Before November 15 2021 Chinese American Planning Council

About The 2021 Expanded Child Tax Credit Payment Program

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

What Is The Child Tax Credit And How Much Of It Is Refundable

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Next Child Tax Credit Payment Opt Out Deadline Is Today

Child Tax Credit Schedule 8812 H R Block

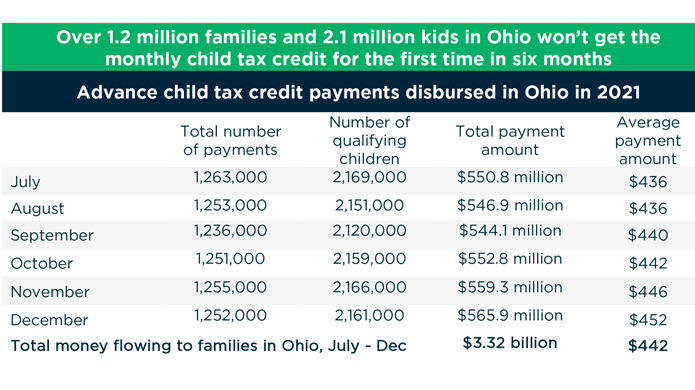

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Gov Urges Eligible Ct Families To Apply For Child Tax Credit Before Nov 15 Deadline Nbc Connecticut

What To Know About The First Advance Child Tax Credit Payment

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal